Understanding your financial situation—income, expenses, budget, investments, and credit score—is crucial. For over 15 years, we’ve explored apps that assist in budgeting and managing personal finances. Committing to a personal finance app can keep you informed about your money and help you tackle debt. Many of these apps are free, while others charge a modest monthly fee. Here are our top three recommendations: Simplifi, ideal for most users; Quicken Classic, perfect for detailed financial management; and YNAB, great for those who struggle with budgeting. Read on to discover why these apps stand out, along with additional options that may suit you even better.

In-Depth Review: Our Top Picks

Best Overall: Quicken Simplifi

Pros & Cons:

- Intuitive dashboard for easy navigation

- Excellent transaction management

- Flexible budgeting tools

- Comprehensive reporting features

- Strong mobile app functionality

- Affordable subscription fee

- Savings goals not linked to live accounts

Why We Chose It:

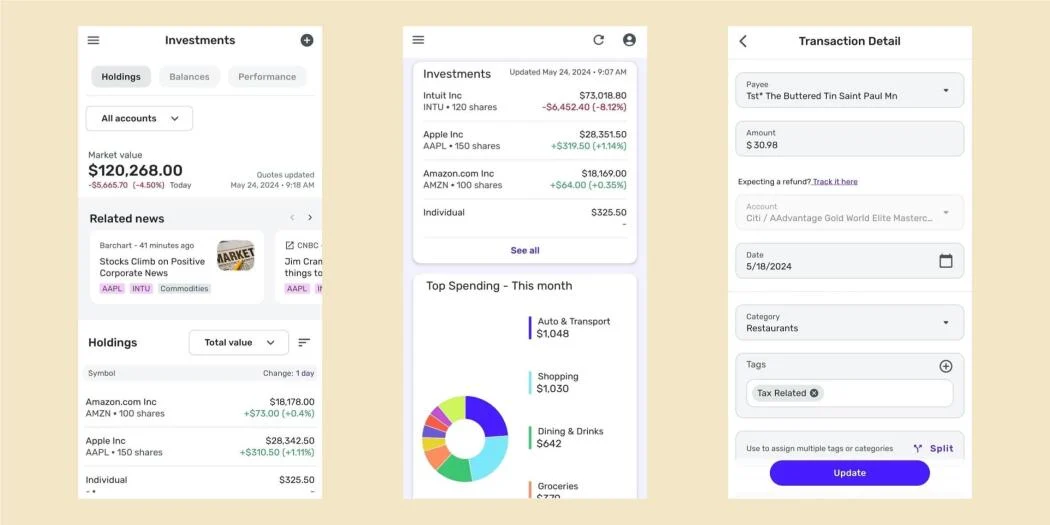

Despite being relatively new, Quicken Simplifi has quickly established itself as an exceptional app. Its user-friendly dashboard provides a clear overview of your finances, and innovative data views, such as watchlists and spending plans, keep you well-informed. The overall experience is enjoyable, making financial management straightforward.

Who It’s For:

Simplifi caters to a younger or less experienced audience wanting to track finances and savings without delving into complex reports.

Best for Power Users: Quicken Classic

Pros & Cons:

- Comprehensive suite of personal finance tools

- Accessible companion website

- Detailed transaction tracking

- Customizable reporting options

- Advanced investment management

- Primarily desktop-based

- Interface can be inconsistent

Why We Chose It:

Quicken Classic has been a staple in personal finance for decades, evolving into a feature-rich application. While primarily desktop software, it offers a companion app for on-the-go access to essential financial data. It justifies its subscription cost with extensive features for budgeting, bills, and investments.

Who It’s For:

Ideal for finance enthusiasts who prefer managing their finances on a desktop and need in-depth tools. Beginners may find the Deluxe version approachable, while more advanced users can benefit from the Business & Personal edition.

Best for a Fresh Approach to Budgeting: YNAB (You Need a Budget)

Pros & Cons:

- Focuses on effective budgeting strategies

- Flexibility enhances success rates

- Extensive educational resources

- Account sharing for families (up to six users)

- User-friendly interface

- Requires commitment to learn

- No investment tracking or bill pay features

Why We Chose It:

YNAB aims to teach users smarter spending habits to enhance savings. While it has a learning curve and demands regular attention, the reward is a customized monthly spending plan that aligns with your financial goals.

Who It’s For:

Best suited for individuals seeking deeper insights into budgeting. It’s ideal for those willing to invest time in learning the philosophy behind effective financial management, applicable to both employees and the self-employed.

Best for Kids: Greenlight

Pros & Cons:

- Excellent parental controls

- Supports savings and investments

- Family safety features included

- 24/7 customer support

- Higher monthly fee for premium levels

Why We Chose It:

Greenlight equips kids with early money management skills under adult supervision. It allows parents to oversee children’s spending while encouraging them to save and invest using a family debit card. The app also offers a high-yield savings account option.

Who It’s For:

Great for families with children aged 8 to 22. The app is affordable starting at $5.99 per month and adapts as children grow, allowing teens to use credit cards and start building their credit scores.

Best for Self-Employed Individuals: Monarch

Pros & Cons:

- Comprehensive setup tools

- Flexible transaction management

- Unused budget dollars roll over

- Smooth, fast user experience

- Unlimited collaborators

- Higher price point

- No credit score tracking

Why We Chose It:

Monarch excels in transaction management and budgeting, making it ideal for self-employed individuals. It features thorough setup tools and a user-friendly interface, allowing for quick financial overviews or in-depth analysis.

Who It’s For:

Perfect for self-employed users looking to track tax-related transactions easily and those focused on understanding how their current decisions impact their long-term financial stability.